Terminal Communications

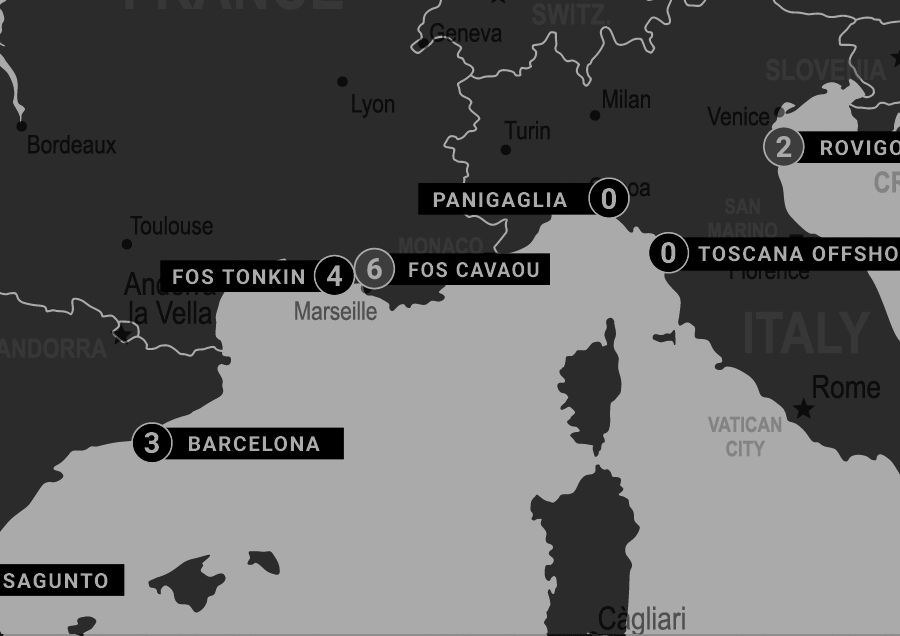

There are currently 25 regasification terminals in Europe alone and others are planned to be built over the next few years. Most terminals operate via a phone, a dedicated website, an application and an email system to conduct trades bilaterally.

Regulatory Landscape

Some terminals are regulated and have tariffs assigned to them and others are exempt, but have Third Party Access (TPA) regimes established by regulators to prevent capacity hoarding (Use It Or Lose It/ UIOLI).

Industry Inefficiency

The lack of a centralized LNG terminal focused solution facilitating transaction processing, and when combined with poor transparency and unclear trading/pricing information in the LNG markets, are not allowing the industry to optimize operations, nor helping foster a secondary market - allowing entry to smaller companies (SME’s).

The Market Need

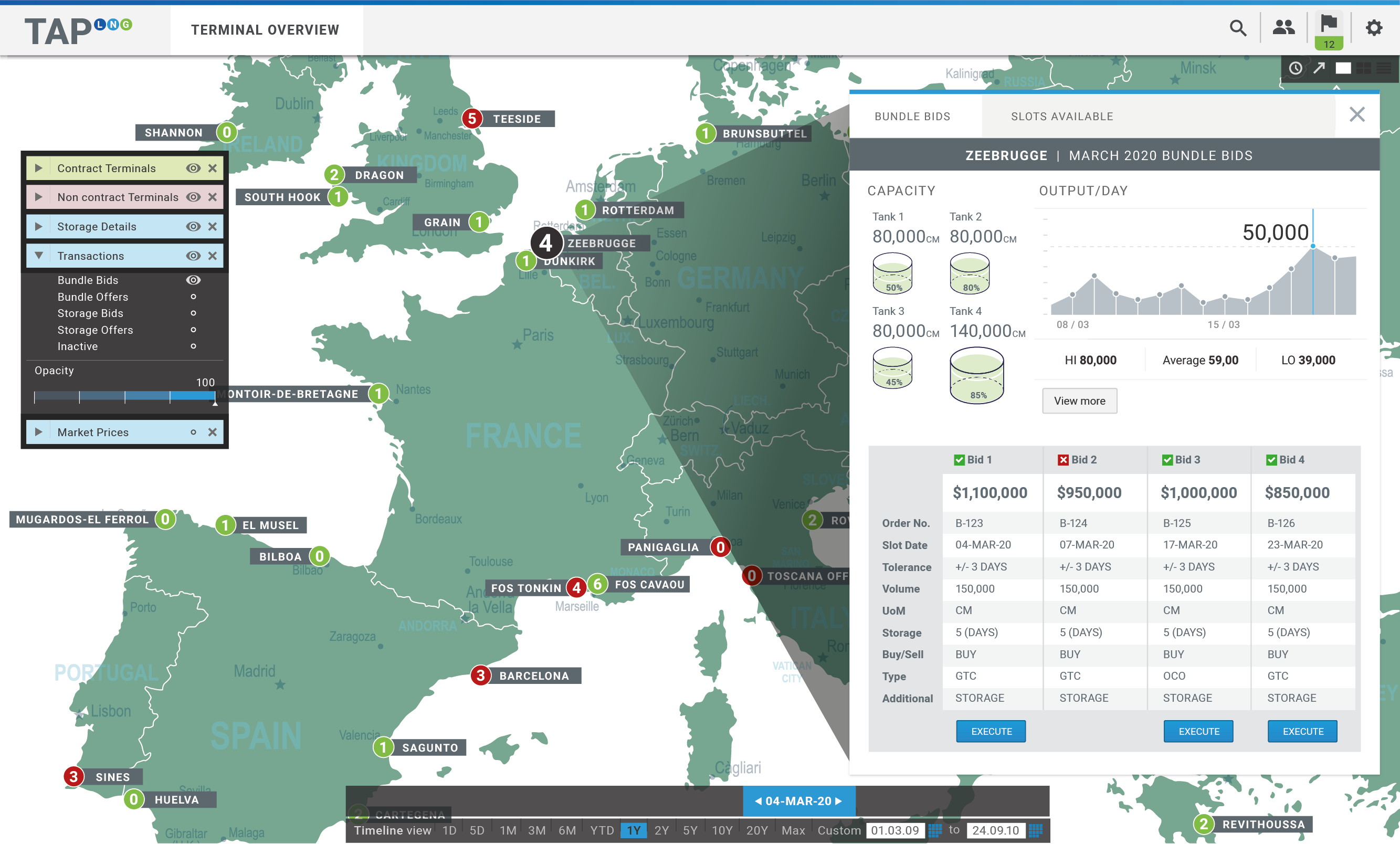

The Solution

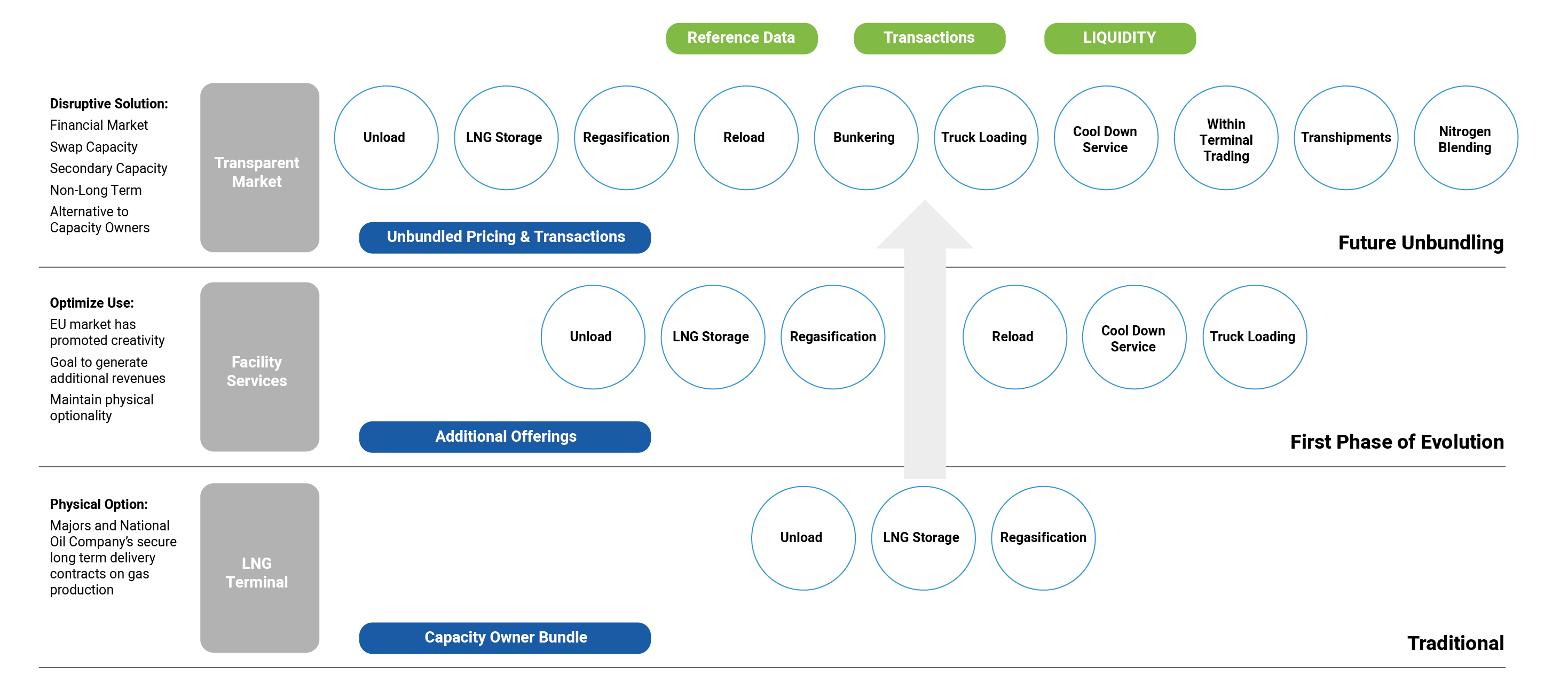

A dedicated / centralized/ aggregated LNG platform solution could result in higher profitability for LNG Terminal and Capacity Holders and would allow trading operations to benefit from an acceleration up the maturity curve by improving business optimization.

Define Trade Definitions

Define Least Common Denominator Trade Details to Accommodate all Regasification Terminal Information

Deal Standardization

Standardize Deal Details into Trade input Screen

Terminal Comparison

Translate Deal into typical Terminal Terminology and T&C’s to Secure Capacity, pursue Standardization to do Apple to Apple Terminal Comparison

Post Price

Offer Bilaterally to Specific Approved Counterparties and to Broader Open Market for execution to Approved Counterparties

Compliance

Post Trade Details consistent with Industry Approved Information that Addresses Confidentiality Concerns of Participants and Current/ Expected Regulations

Aggregated Views

Improved Trading workflows by unifying all data into one place through a series of easy to use interfaces.

Increased Revenues

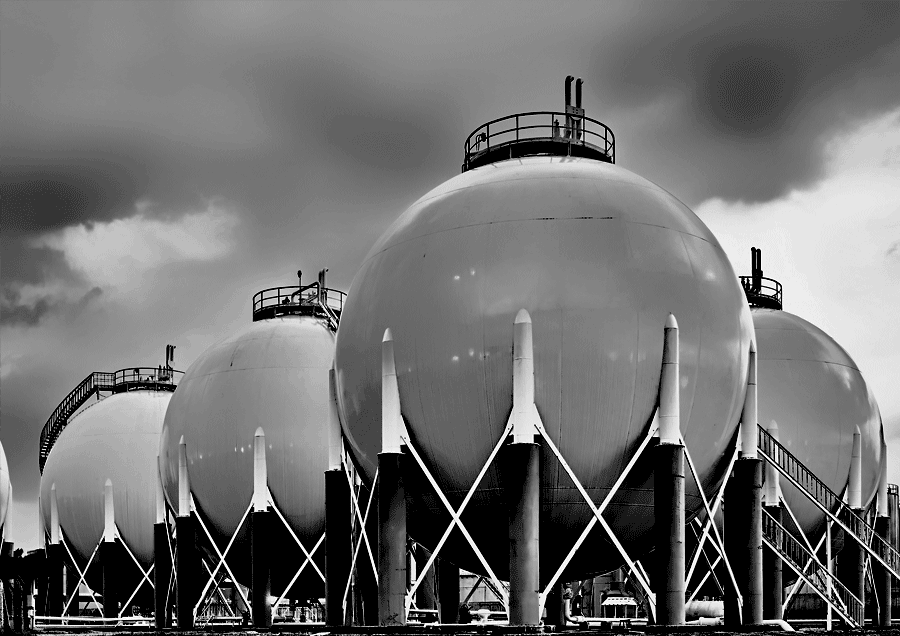

Enabling greater revenues and financial returns for LNG regasification terminals.

Terminals offer additional services such as trucking, reloading, storage, transhipments, etc, to increase revenues, provide optionality and profit above their traditional business plan. There potentially exists further opportunity to extract more value from these services and to increase volume. All this while supporting country requirements to improve security of supply

Transforming Business

Developing a new electronic platform to transform business processes and business interfaces – Opportunities exist to develop an electronic platform to:

Centralise up-to-the-minute data on each participating LNG regasification terminal

Allow terminals to market and trade their services online using a common platform across all terminals

Invite (new & existing) trading counterparties to tender for regasification terminal services

Transparency & Standardisation

Creating greater transparency in the LNG market and improving levels of standardisation –

As the world moves to reducing emissions levels and sourcing cleaner energy, the LNG market will eventually outpace other fossil fuels in terms of demand and end use.

It important to develop greater transparency in the LNG market and drive standardisation where it is most needed to help open the market up, create a secondary market and create more liquidity and greater price discovery.

What was once a domestic gas market is rapidly becoming an international gas market providing an environment of improved security of supply and lessening the dependence on a single supplier or nation.

No longer will domestic gas markets operate as monopolies or oligopolies but in a freer more perfect market. Domestic importers could later create their own pipeline networks for reselling or simply develop more storage for strategic reserves.